Leslie R. Caldwell, former Assistant Attorney General for the Criminal Division of the DOJ, told a group of bankers while in office that they need to expand upon the ‘suspicious activity reports’ they are required to file on their customers by calling law enforcement directly on anyone withdrawing a large amount of cash, according to investor and financial blogger Simon Black.

Banks are already required to file ‘suspicious activity reports’ on their customers, with threats of fines and even jail time for directors if financial institutions don’t meet quotas.

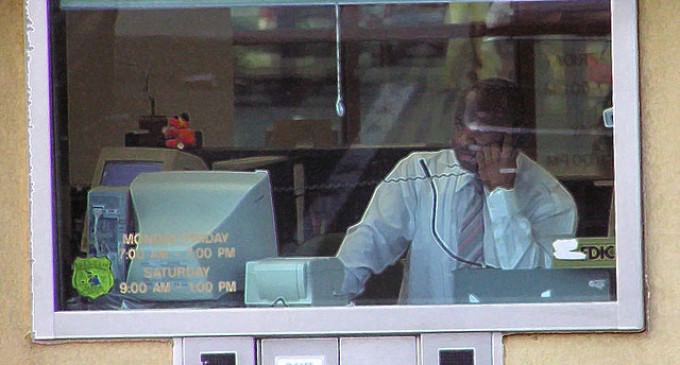

But as investor and financial blogger Simon Black points out, last week, “A senior official from the Justice Department spoke to a group of bankers about the need for them to rat out their customers to the police.”

Assistant attorney general Leslie Caldwell gave a speech in which he urged banks to “alert law enforcement authorities about the problem” so that police can “seize the funds” or at least “initiate an investigation”.

As Black highlights, according to the handbook for the Federal Financial Institution Examination Council, such suspicious activity includes, “Transactions conducted or attempted by, at, or through the bank (or an affiliate) and aggregating $5,000 or more…”

Black provides a chilling scenario under which an attempt to withdraw your own money from your bank account could end with a home visit from the cops.

“As you pull into your driveway later there’s an unexpected surprise waiting for you: two police officers would like to have a word with you about your intended withdrawal earlier,” writes Black, who accuses banks of already operating as “unpaid government spies”.

“Do you need to withdraw cash to purchase a used car from a private seller? Or perhaps you are pulling out some emergency cash for a loved one,” writes Mac Slavo.

“Either one of these activities are now considered suspicious and if your cash withdrawal amounts to even a few thousand dollars your bank teller is under a legal requirement to alert officials about your suspected criminal activity. And before you argue that you can’t possibly be a suspect because you have done nothing wrong, consider that even being suspected of being a suspect is now enough to land you on a terrorist watchlist in America.”

The war on cash is intensifying as authorities attempt to crack down on one of the few remaining modes of anonymity.

Over in France, Finance Minister Michel Sapin hailed the introduction of measures set to come into force in September which will restrict French citizens from making cash payments over 1,000 euros.

The new regulations, introduced in the name of fighting terrorism, will also see cash deposits of over 10,000 euros during a single month reported to anti-fraud authorities.

Meanwhile, in the UK, HSBC is now interrogating its account holders on how they earn and spend their money as well as restricting large cash withdrawals for customers from £5000 upwards.

Back in America, purchasing Amtrak train tickets with cash is being treated as a suspicious activity as part of a number of behaviors that are “indicative of criminal activity”.

Banks are also making it harder for customers to withdraw and deposit cash, with Chase imposing new capital controls that mandate identification for cash deposits and ban cash being deposited into another person’s account.

How many times is this going to circulate?

This is nothing new. It’s been in effect since the Bush days. In 06 or 07 I had deposited 50k in my credit union account, and a few months later went in to withdraw a large portion of it, and had to explain to the teller, and then the bank manager that it wasn’t anyone’s damn business what I intended to do with the money. Trying to explain to them that it made no sense to give me a ration of$#%&!@*over withdrawing money that I had put there in the first place didn’t fly either. They apologized, and said it was due to federal requirements for the purpose of countering terrorism and drug trafficking. It may have been given a pass by the public at the time because of attitudes post 9/11, but in light of the government’s quest for unlimited power and control under the Obama administration, its looking more and more like that is the only aim for that policy

F them

$10,000 or more must be legally reported, even by credit unions. Even if you split up the withdrawal transactions. I was curious about this a few weeks ago, so investigated myself.

Cartels.

Document.

Been her for years. No Duh.

They have been doing this for years already.

You mean they are lowering it from 10,000k to 5000. Banks also have to report large cash deposits and irregular deposits. Ben going on to years. Small businesses have been thrown into civil forfiture, a practice that needs to be repealed

Obama’s DOJ…