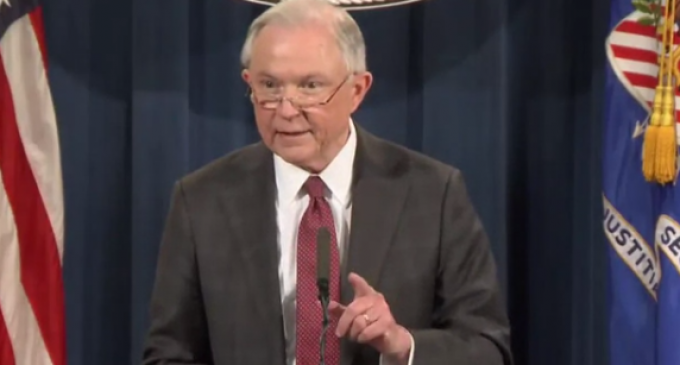

Like Santa Claus, Attorney General Jeff Session is making a list and checking it twice. That’s a list of the U.S. sanctuary cities that stand to lose federal law enforcement grants because of their refusal to cooperate with Immigration and Customs Enforcement (ICE).

Last Tuesday, the Justice Department announced that sanctuary jurisdictions (including cities, counties and states) will lose access to certain federal grants in 2017 if they prohibit their law enforcement officials from communicating with ICE.

They also will lose federal funding if they block ICE from interviewing jailed inmates or if they fail to notify ICE of the pending release of criminal aliens ICE seeks to deport.

The federal grants in question as known as the Byrne Justice Assistance Grants (Byrne/JAG), which are the largest source of federal criminal justice funds for state, local and tribal authorities.

The move fulfills a Trump administration promise to create consequences for the more than 300 U.S, sanctuary jurisdictions if they impede federal immigration enforcement. Details on the cities involved can be found on the next page.

Be sure to get the “welcoming cities” here in Michigan too. Same thing different name

Great job.

He sure has done a good job of avoiding the Swamp rats though

GET CT GOV. MALLOY….WE HAVE 16 CITIES ON THE LIST!!!!!…GET MALLOY NOW SESSIONS!!!!

Be sure to get DearBorn Michigan …

Hope San Antonio, Texas and Houston, Texas and Austin, Texas on the list!!!

Fannie Mae and Freddie Mac

After eight long years of cover-ups, bald-faced lies, and judicial obstruction, the government has finally released thousands of documents

demonstrating that the Obama Administration created false pretenses to unlawfully siphon tens of billions of corporate cash from Fannie

Mae and Freddie Mac. These documents clearly demonstrate that senior government officials knew the GSEs were on the verge of sustained

profitability and took actions to usurp all of those profits. Indeed, the documents reveal that these officials lied to the public and perjured

themselves in federal courts. The so-called “Net Worth Sweep” was unnecessary to prevent a “downward spiral.” Put simply, we now have

unambiguous evidence that the Obama varsity team knew what their statutory authorities were, willfully exceeded those authorities to steal

billions of dollars from investors, and subsequently engaged in a cover-up to hide their wrongdoing.

When you follow the cash, it’s easy to see that Fannie and Freddie have generated hundreds of billions in profits, taxes, and consumer savings.

Each held tens of billions of tangible value and maintained tens of billions in earnings power – even at the worst point of The Great Recession.

Each had the wherewithal to pay all bills and pursue its stated mission of providing liquidity when all others cannot.

Federal agencies continue to defend contrived accounting gimmicks by arguing that they followed the law and, notwithstanding, they are above

it. As more and more documents are released, the Department of Justice will see that the actions undertaken by former officials undermine their

defenses and long-established laws. Fannie and Freddie can safely return to their role of insuring the uniquely American housing finance system

against catastrophic risk with private capital. There is a proven blueprint to succeed, and we hope to successfully resolve this matter before

reaching the Supreme Court of the United States.

After all, capital markets are based on the sanctity of contracts – the original buyers’ and sellers’ expectations and rights travel with a contract

no matter who holds it. When this saga ends, we expect contracts to be honored and substantial value for all stakeholders.